Professional |

|

|

|

||||||||||||

|

2011 - 2015 Sky Analytics, Inc. Framingham, MA Co-Founder and Chairman |

|

I was one of four founders of Sky Analytics, a company that is pioneering the use of objective, easy-to-understand analytics within the legal industry. My co-founders were Jonathan Kash as Chief Technology Officer, Doug Ventola as President and Chris Bullock as Chief Marketing Officer who joined in 2009, 2011 and 2012, respectively.

Like so many new companies, Sky was founded based on the need for a fresh approach. As Shareholder.com's president (see below) I had led a complex lawsuit against our largest competitor. Although we settled the lawsuit very successfully, our legal costs had nearly reached $2.5 million, and the case was still months away from trial. Our lawyers were excellent practicing the profession of law but simply did not have the tools or inclination to manage the process of law. The result was that our legal costs were wildly out-of-control. Not only was this expensive for our small company, but it was fundamentally unfair to our dedicated employees who for the most part managed the company's expenses as tightly as if they were their own. After The Nasdaq Stock Market acquired Shareholder.com in 2006 I had the time to analyze the lawsuit we had recently settled, perhaps something only an engineer would enjoy. The result was two white papers, Anatomy of a Lawsuit, and A Call for Legal Entrepreneuship. But more importantly, out of this research came the realization that there was a major business opportunity for any company that could successfully provide the legal industry tools for better managing the legal function. Hence, Sky Analytics was born. The legal industry was literally a thousand times larger than Shareholder'com's investor relations market, there were huge savings to be had, and Sky would provide the tools to realize those savings with little or no competition. Selling into any new market is difficult, but the conservative legal market was especially challenging. But once a client installed Sky Analytics, our computer analysis typically found millions of dollars in potential savings in a company's legal spending. Word quickly spread through the industry and by late 2014 Sky had some of the nation's largest financial, computer and pharmaceutical companies as clients. The legal services industry had also taken notice, and like Shareholder.com before it, nearly all the major players in the market, all interested in a foothold in legal analytics, expressed interest in possibly acquiring Sky Analytics. Most potential suitors did not have a clear vision of where the market was going, but Huron Consulting did. They quickly saw legal analytics developing as the "gateway" to their legal consulting and services business. Sky's legal analytics would provide the insights into where clients could improve their legal operations, and Huron would then provide the consulting and management services to realize those efficiencies. Truly a synergistic relationship. So after an extended negotiation during which Huron never waivered in its commitment, Sky Analytics became a part of Huron Consulting with Jonathan, Doug and Chris joining Huron, along with all other Sky employees, to lead Huron's efforts in legal analytics. And once again, I retired.

|

|

1982 - 1991 Alliant Computer Systems Littleton, MA Co-Founder and CEO |

|

I left Data General in May, 1982 to found Alliant Computer Systems. Joining me as a co-founder and Vice-President of Software was Craig Mundie with whom I had worked at Data General. Two months later, Rich McAndrew joined as the third founder and Vice-President of Hardware. Rich and I had worked together at Data General nearly ten years earlier on the Eclipse computer. We originally named the company Dataflow Systems, but changed the name in 1985.

Our vision was to provide a growth path for Digital Equipment's highly-successful VAX computers using parallel processing. A great deal of academic research had been done over the years on parallel processing, or the application of multiple computers to the execution of a single program (not to be confused with multi-processing where multiple computers are applied to multiple, independent programs). Our strategy was to commercialize this research. We elected to base our system on the CEDAR research project headed by Dr. David Kuck at the University of Illinois. Our objective was to take an existing VAX Fortran program and run it, unchanged except for re-compilation, significantly faster on up to eight processors operating in parallel on that single program. We intended to position our computers as "mini-supercomputers", or machines which approached supercomputer speeds at minicomputer prices. Within six months we had developed a detailed business plan, a basic systems architecture and raised $4.7 million in venture financing from Kleiner Perkins, Venrock and Hambrecht & Quist. Our first products, the FX/8 and FX/1, were announced July 23, 1985 after an intense development project. Our announcement generated considerable excitement in the marketplace and the media. The Wall Street Journal, for example, stating that "Alliant Computer Systems Corp. plans to introduce a line that it says provides much of the vast computing power of supercomputers at far lower cost...a $450,000 version of its system would be more than four times faster than a comparably priced Digital VAX superminicomputer." The excitement wasn't unwarranted. Our hardware and software team had developed truly innovative new technology including a parallelizing compiler, a non-blocking crossbar memory/processor switch and extremely fast inter-processor syncronization. The speed of these computers opened up new applications such as speech recognition at Bell Labs, 757/767 flight simulators at Boeing and new cryptography applications at certain government agencies. As a result, these first products were an immediate success generating over $30 million in revenues in 1986, the first full year of production. Our strong revenue and profitability growth allowed us to go public in December, 1986. Morgan Stanley and Hambrecht & Quist were the lead underwriters. Within a year Alliant had a market capitalization of nearly $500 million. We used the financing proceeds to broaden our product line and grow our business internationally. In 1987 we announced follow-on products to the original line and had established ourselves in Europe and Japan which together would generate nearly forty percent of our total revenues the next year. We sold our systems directly in Europe but established an independent joint-venture in Japan. By 1988 though we were in trouble. Revenue growth was beginning to flatten, expenses were rising, and the computer landscape was changing quickly. Just as minicomputers in the 1970s had undercut mainframes and our mini-supercomputers had undercut supercomputers, smaller computers -- workstations from Sun and Apollo and even the desktop PC -- were beginning to undercut us. Furthermore, the growing complexity of our systems caused product development slippages which affected our ability to compete in a performance-focused market. Our independent Japanese joint-venture was accumulating huge losses. We responded with aggressive new product offerings while reducing headcount and expenses everywhere possible. Although these efforts were successful in slowing the negative momentum they did not stop it, much less reverse it. By early 1991 the Board of Directors had come to an impasse as to strategic direction and I was asked to leave. Craig Mundie took over as Chief Executive and I left the company after nearly ten years in that role. Unfortunately, Alliant did not survive. But for a short period, a highly capable team of people, truly innovative technology, and exciting new markets all came together for what most of us feel was a highlight of our careers. For me, looking back now after more than thirty years, I consider the period from 1982 through 1985 when we developed and shipped our first Alliant systems as the most satisfying and proudest of my career. But just as the beautiful clipper ships were eclipsed by the steamship, our elegant technology was dying and the future lay with the microprocessor and personal computer.

|

|

1969 - 1982 Data General Westboro, MA

Director, Advanced Systems |

|

I first met three of Data General's four founders when Ed deCastro, Henry Burkhardt and Dick Sogge team-interviewed me together for two hours. Somehow I got through it and was offered a job. Afterwards I bought myself a shrimp cocktail, steak and Lowenbrau, maybe a couple of Lowenbraus.

I started a month later as Data General's 43rd employee. My first project was as a junior engineer helping to design a high-end extension of Data General's original computer, the Nova. Things moved fast in those days. The new machine, marketed as the Supernova, was designed, tested and announced in seven months. It only sold moderately though due to limited demand at the time for high-performance; a machine ahead of its time. Shortly after wrapping up the Supernova, I read about a breakthrough integrated circuit from Texas Instruments. The circuit was a 64-bit random-access memory ("RAM"). It struck me that this chip could be the basis for the successor to the original Nova since the Nova was based on an architecture which thrived on RAM. After proposing an initial design, I was given responsibility for the design of the new computer. Once again, the development process was only about six months and the new machine, marketed as the Nova 1200, was announced in late 1970. It was a major success generating over a billion dollars in revenue over its product lifetime. Not long after the Nova 1200 went into production, we were beginning to feel pressure from DEC's PDP-11/45, a high performance machine that was outperforming our current high-end computer, the now aging Supernova. After proposing an approach based on a microprogramming architecture, I was made project engineer for the effort with the directive to "get a '45 Killer' out as fast as possible." It didn't happen. The project took nearly two and a half years. Too much new technology, too many people, too little experience with larger, more complex projects, all contributed to the delays. The machine was so late that we began calling it the "Elusive Bird" after song lyrics lamenting "that elusive bird of love." Marketed as the Eclipse, it was announced in October 1974 and was immediately successful running three to five times faster than the PDP-11/45. The speed of the Eclipse made many new applications possible. One new area I was quite involved in was computer-aided-tomography, or CAT Scanners. Working closely with both British-based EMI, the technology's pioneer, and General Electric, the largest US-based manufacturer, Data General became through the mid-1970s the exclusive provider to these firms for CAT Scanning computers. Once again though technology was changing and by 1976 Data General needed a major revamping of its computer architecture to accommodate larger memory capacities. DEC was already well along with their next generation architecture, soon to be announced as the VAX 11/780. After consideration, it was decided to abandon our current approach, an extension to the Eclipse based on memory segmentation, and develop an entirely new "high-level language architecture." And therein lies a story. Actually a Pulitzer prize winning story written by Tracy Kidder in his book, The Soul of a New Machine. The book documents a battle of two competing projects within Data General: the Fountainhead Project ("FHP") based on high-level languages, and the Eagle led by Tom West (Tom passed away May 19, 2011. His Obituary.), started well after Fountainhead and based on the existing Eclipse using, yes, memory segmentation. For the whole story, read The Soul of a New Machine where I play the role of the "North Carolina Leader" heading the FHP Project. The Eagle, announced as the Eclipse MV/8000, won the race and gave Data General a strong competitor to DEC's VAX. The Fountainhead Project was completed and ultimately ran benchmarks significantly faster than any commercial minicomputer, faster even than IBM's 370/158, a multi-million dollar mainframe. But Fountainhead was late to market and did not survive. Once the smoke cleared from the Eagle and Fountainhead competition, I was promoted to Director of Advanced Systems responsible for all Data General's high-end computing efforts. Ironically, these efforts were based exclusively on my erstwhile competitor, the Eagle. After spending a year in this role developing extensions to the Eagle, I decided that if I ever wanted to start my own company, now was the time. So in May, 1982 I left Data General after thirteen years to form a new company -- the nature of which I had only a general idea. For an insightful view into Data General, and the computer industry in general during this period, read Bill Foster's autobiography. Bill was Data General's software vice-president in the late-seventies and went on to found Stratus Computer Data General was tremendous fun during most of the time I was there. The founders, deCastro, Burkhardt, Sogge and Richman, were highly-motivated, self-directed individuals who were extremely competent in their respective areas. For the most part, they treated employees as equals, so if you didn't learn to 1) know what you're talking about, 2) find solutions to problems without much direction, and 3) thrive in a near Darwinian environment, you didn't last. Most of us did though and dozens went on to start their own companies.

|

|

1966 - 1969 General Electric Company Oklahoma City, OK

Design Engineer |

|

During the 1960s General Electric was focused on three strategic areas: atomic energy, jet engines and digital computers. Only jet engines were ultimately successful, but in the late 1960s GE was still strongly committed to competing with IBM. During that time I worked in their computer division on a work-study program while attending college. It was an exciting place to work.

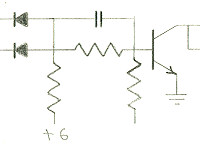

My first position was as a manufacturing technician working on flow-soldering, wire-wrap and circuit-board testing machines. My real interest though was computer design so when the early integrated circuits became available I demonstrated how the division's largest volume circuit board, NAND-gates constructed of discrete transistors, resistors and capacitors, could be replaced with an integrated circuit version. This approach proved to be successful saving over $1 million (nearly $8 million today) the first year of production. Shortly afterwards I was promoted to an entry-level Design Engineer position, the youngest in GE. At the time one of our department's biggest problems was the inability of our magnetic tape drives -- huge, complex mechanical monsters in those days -- to read marginal tapes. IBM drives could, ours couldn't. After studying the problem, I thought I knew why and proposed that a new circuit be developed to fix the problem. Management agreed to let me work on the solution, perhaps only to goad the corporate R & D Center in Schenectady, NY which had been contracted by our division to solve the problem. My circuit design used another new technology, Operational Amplifiers. "Op Amps" had many advantages over traditional circuits which I was able to apply to the data recovery problem. The new circuit worked well and "In one instance, a tape generated by an IBM system at a Chrysler Corporation site consistently generated 91 errors when read on the GE system. The tape was read error free in the same GE tape drive by replacing the old read circuits with the newly designed circuit." In 1969 I was selected as one of four outstanding engineers in our division. Being young and restless, I left GE a few months later -- and a semester before graduating from college -- to join Data General. Although it's been over 50 years, I still remember many of the people I worked with: Ralph Ketchum who hired me and later went on to develop the high-pressure sodium light which revolutionized street lighting. Morgan Morgan-Voyce, an English engineer, who taught me that that there is no such thing as an arbitrary engineering decision. And Jane Varga, a rare female engineer in those days, who was meticulous in her analysis and design. They were good mentors. |